Regulatory Requirements

EBA Mandate

The European Banking Authority (EBA) mandated that all payer who access their payment account online and initiate electronic payment transactions through a remote channel must be strongly authenticated (aka Strong Customer Authentication (SCA)) commencing September 14, 2019. The card organizations seized this opportunity to overhaul the established 3D-Secure protocol for cardholder authentication and to address several issues that curbed adoption in the market.

3DS 2.0

Previously, internet merchants had the choice to either present a cardholder challenge (e.g. TAN / password) or to give 3DS a pass entirely. Some adopted a dynamic approach based on PSP or own risk assessment, but many merchants valued a frictionless checkout and high conversion rates more than the potential benefits of a liability shift. The card organization's overall strategy for 3DS 2.0 is to reduce friction through an improved cardholder experience (device awareness) and to leverage exemptions from SCA based on robust transaction risk analysis (TRA) with the ultimate goal of delivering optimal authorization performance and conversion rates. Thus, TRA is key to delivering frictionless payment experiences for low-risk remote transactions. Therefore the 3DS 2.0 protocol introduced a plethora of additional data points that can be transferred to the issuer to aid transaction risk analysis and to apply excemptions from SCA.

SCA will be required when:

- The transaction is not out of scope of the PSD2 RTS

- No PSD2 SCA exemption applies for a payment transaction

- Adding a card to a Merchant’s file (card-on-file)

- Starting a recurring payment arrangement for fixed and variable amounts, including setting the initial mandate for Merchant-Initiated Transactions

- Changing a recurring payment agreement for a higher amount (premium offering for example)

- Setup of white-listing (or viewing/amending white-lists)

- Binding a device to a Cardholder

Liability Shift

As a rule of thumb, when cardholder authentication was performed through 3-D Secure, merchants are typically protected against e-commerce fraud-related disputes and liabiliaty shifts from the merchant / acquirer to the issuer. There are exceptions to merchant dispute protection though. In the context of 3DS 2.0 merchants are regularily not protected if granted excemptions according to PSD2 RTS were actively requested by merchant / acquirer.

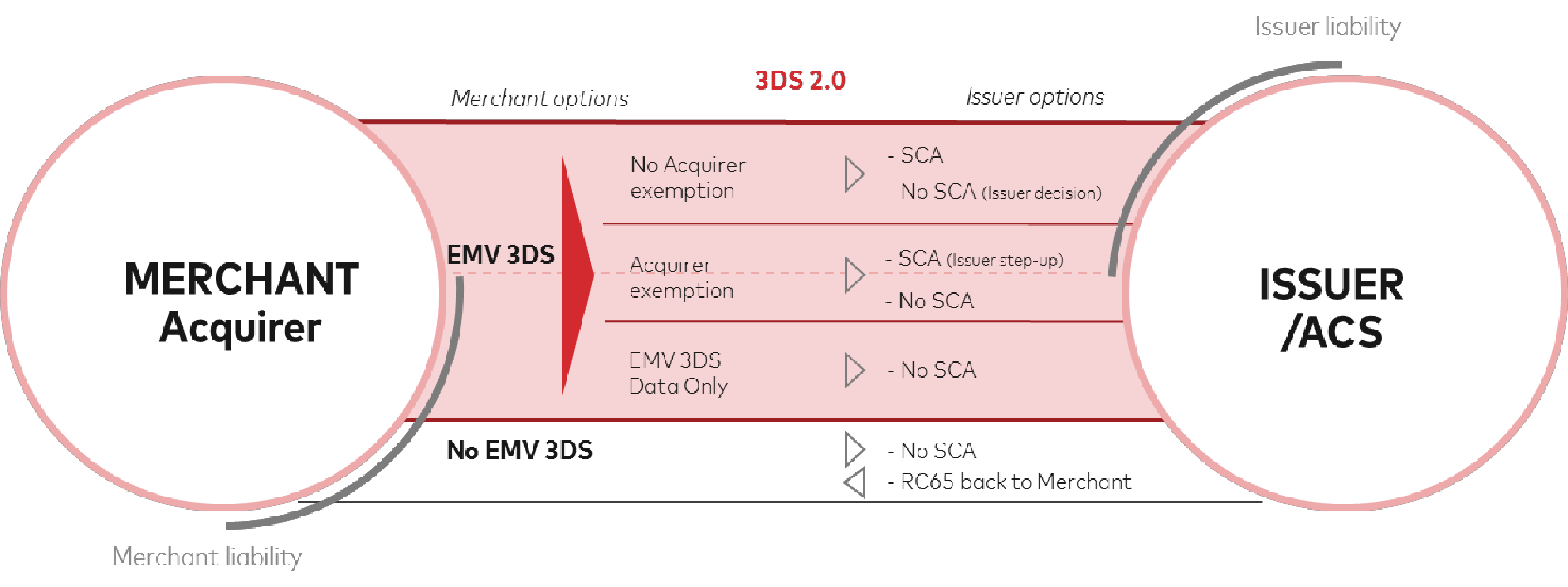

The following diagram depicts options and liabilities under PSD2 RTS requirements according to MasterCard.

3DS 2.0 and GDPR Compliance

Cardholders must be provided with detailed information about how their data is collected, used and processed. This can be ensured via a Privacy Notice including at a minimum the types of data being processed, the purposes of their processing, data uses, etc. Card organizations and Issuers will not use EMV 3DS data for other purposes than fraud prevention and authentication. It excludes the usage of personal data for other purposes, such as sales, marketing and data mining (other than fraud prevention as purpose) activities.

PSD2 SCA Exemptions and Exclusions

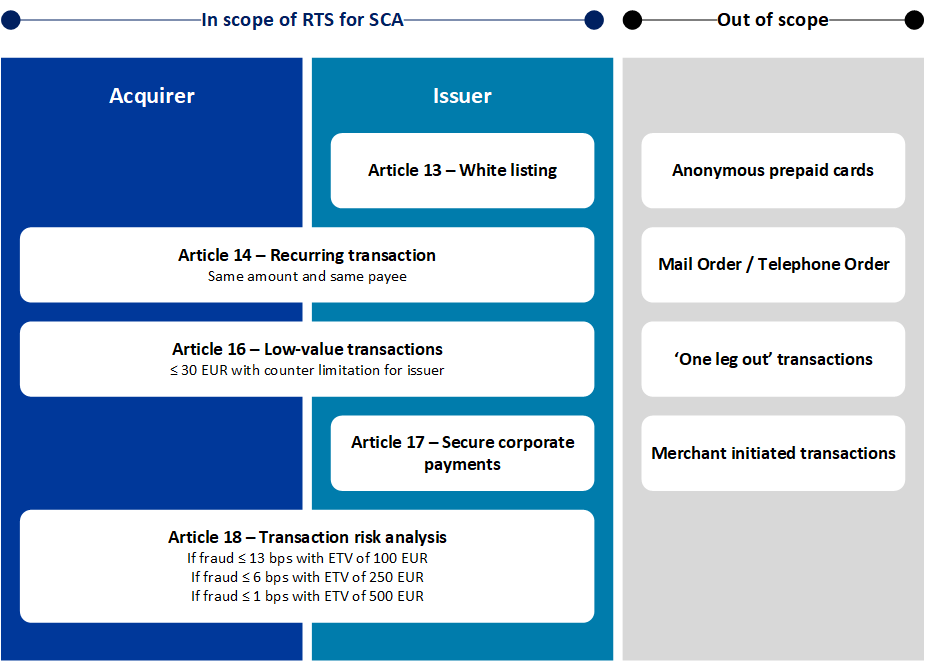

There are some important excemptions to SCA according to the regulatory technical standards (RTS) that may apply in various conditions which are depicted in the following digram.

Payment platform

Authentication Options

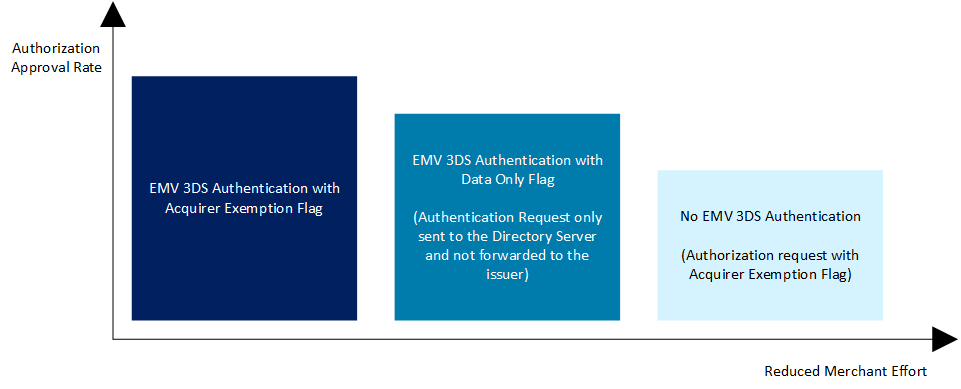

An acquirer may be allowed to not apply SCA due to to low fraud rates and TRA. For these excemptions there are various processing options available as depecited in the diagram below.

EBA-Op-2018-04, Paragraph 47 - Clarification on PSP (Acquirer Fraud Rates)

Message Version 2

To handle the amount of additional non-payment data and to maintain downward compatibility as much as possible BNP decided to version its Payment platform card interface via the additional data element MsgVer. The upgraded API is still based on key-value pairs but relies heavly on Base64 encoded JSON objects to aid readibility and client-side scripting.

Merchants will still be able to use our classic interface for requests even with 3DS 2.0 but there are some limitations:

- Many additional data points for issuer risk analysis are not available and thus, the frictionless ratio might be lower

- API responses and notifications do include new JSON objects to cater for 3DS 2.0 protocol specifications and require modification of existing merchant integrations

For these reasons it is highly recomended to upgrade to version 2.

Soft decline handling

In case a transaction is missing SCA, issuers might respond with so-called soft declines. This means that the transaction authorization request is declined by the issuer, however, the same transaction can be initiated again. The main reason for soft declines emerging in the context of 3D Secure is that issuers are not accepting SCA exemptions requested by the merchant when such is sent directly to authorization or when the merchant requests payment without authentication being carried out beforehand. The best practice is to restart the payment including 3DS.

With Automated Soft Decline Handling feature, configuration based, Axepta Payment platform will react to the soft decline response by automatically restarting the payment forcing SCA. The Payment platform will then automatically create a new payment on behalf of the merchant and include 3DS flow.

IMPORTANT:

- From a user’s point of view, customers will not notice any difference and will not need to re-enter their credit card data. The whole process is managed by the Axepta Payment platform.

- Please note that this solution is not available for server-to-server integrations, as Axepta Payment platform does not have the client (browser) in control to start the 3DS flow. For server-to-server integration, the merchant is responsible to re-trigger the payment with 3DS flow and most important forcing the SCA challenge through the available parameter JSON threeDSPolicy (challengePreference = mandateChallenge).

Whitelisting of trusted beneficiaries

A cardholder might opt to add a merchant to a list of trusted benficiaries maintained at the issuer to excempt this particular merchant from SCA with future payments. This will usually occur during a cardholder challenge but cardholder's might also be able to manage a list of trusted beneficiaries through their banking app for instance.

Merchants may benefit from a whitelist excemption if requested and if a cardholder challenge is not required otherwise.

Recurring transactions

Recurring transactions are a series of transactions processed following an agreement between a cardholder and a merchant where the cardholder purchases goods or services over a period of time and through a number of separate transactions with the same amount. The initial transaction must be authenticated (i.e. cardholder initiated transaction (CIT)). Subsequent recurring payments are out of scope of RTS SCA since they are regularily merchant initiated (i.e. without customer beeing in session).

Low-value transactions

Issuers may exempt transactions from SCA provided that the following conditions are met:

- the payment amount does not exceed EUR 30,

- the cumulative amount of previous payment transactions without SCA does not exceed EUR 100,

- the number of previous payment transactions without SCA does not exceed five consecutive payment transactions.

Please note that low-vale exemptions must be requested to be considered for a frictionless authentication flow.

Transaction risk analysis

Acquirers and issuers are allowed not to apply SCA provided the overall fraud rate is not higher than the reference fraud rate for the exemption threshold value (ETV) specified in the table below and where the risk-based assesment of each individual transaction can be considered as low risk.

| ETV | Card-based payments |

|---|---|

| EUR 500 | 1 bps |

| EUR 250 | 6 bps |

| EUR 100 | 13 bps |

One-leg out transactions

One-leg out transactions are such transactions where either the payer’s payment service provider or the payee’s payment service provider are located outside the European Union.

Payment service provider in the context of a card based transaction and in the spirit of the PSD2 are regularily acquirer and issuer.

Thus, neither the nationality of the cardholder nor the merchant's business location are relevant for the assessment wether a transaction is out of scope due to the 'one-leg out' rule.