| Logo | |

|---|---|

| Info |

|

Summary

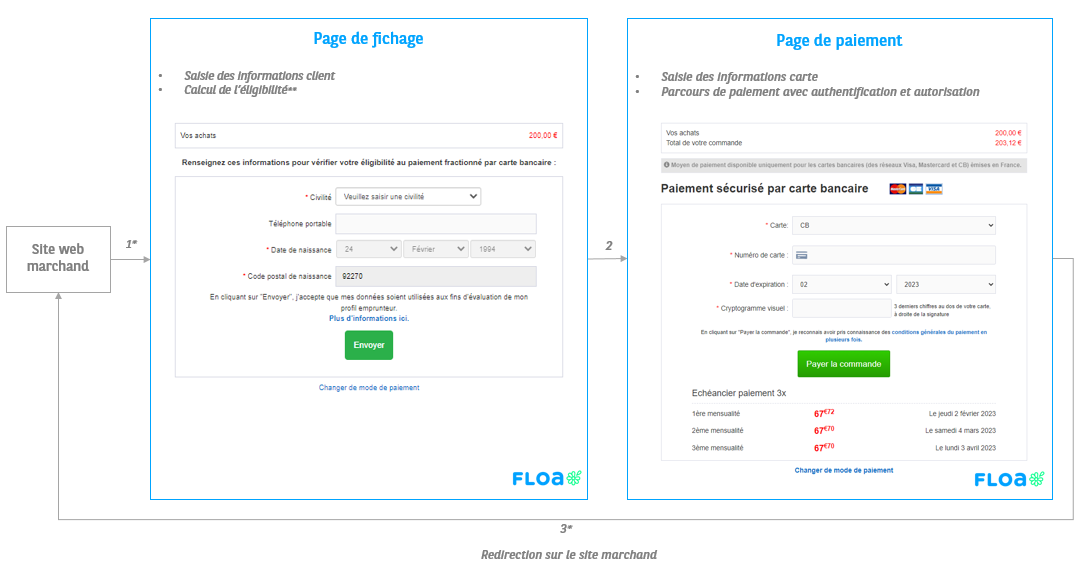

Payment journey

*Steps 1 and 3 are performed by Axepta

** Eligibility is used to estimate the level of confidence assigned to a payment request by a customer.

This involves statistical processing of historical data relating to customer orders. Eligibility can be reassessed using information contained in the National Personal Credit Repayment Incident File (FICP).

Onboarding

After signing the contract

The merchant receives an email from 'Professional Services' Floa team, who will accompany him duringFLOA implementation.

This team will be in charge of the deployement in production mode on FLOA side.

Identifier : Sandbox/Production

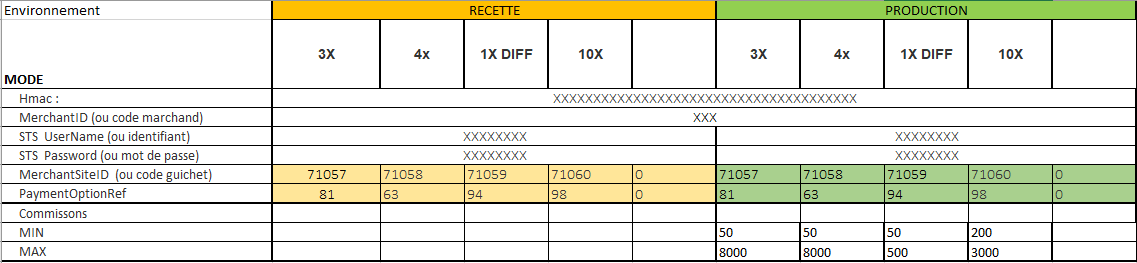

Once the technical configuration is complete, FLOA sends to the merchant an Excel file (see below) with the test and production crendentials.

The key data to be used in queries are the MerchandID and the MerchantSiteID.

You will find below a short recipe description and production identifiers.

| DATA | Detail | API AXEPTA Mapping |

|---|---|---|

| MerchandID | Merchant ID created by FLOA platform - Optional data | MerchantIDExt |

| MerchantSiteID | Unique identifier created by FLOA for each of the payment methods purchased by the merchant (3X/4X/manual capture/automatic capture) | PayType |

| MIN | Minimum customer Cart - Below this amount, payment cannot be made via FLOA | - |

| MAX | Maximum customer Cart - Beyond this amount, payment cannot be made via FLOA | - |

FLOA registration request on Axepta

Once the Excel file has been received, the merchant sends it to his BNP Paribas account manager specifying the Axepta Merchand ID.

Sharing this element is imperative so that BNP Paribas teams can proceed with the MerchandID configuration.

Onboarding on merchant website

Implementation of FLOA regulatory principles

FLOA provides merchants with a set of regulatory and marketing resources necessary due to legal obligations and optimize the conversion rate.

More information: Regulatory and marketing resources

Once FLOA is integrated on the merchant site, the merchant contacts the marketing department of FLOA (marketing@floa.com) so that it can carry out the necessary checks to put in production.

FLOA must validate compliance with regulatory and marketing requirements in order to proceed with production environement.

Payment schedule displayer

The FLOA payment schedule can be simulated and displayed on the merchant's website so that customers can project themselves into their purchases.

To use this conversion tool, you must use the specific parameter ''&EventToken=SCHEDULE'' in your request.

The schedule calculation is based on the total amount submitted in the request.

Example :

Request

&TransID=TID603510031101338549 &MerchantID=BNP_DEMO_AXEPTA &RefNr=ADDZ3022302 &Amount=20000 &Currency=EUR &MerchantIDExt=38 &PayType=7017 &CustomerID=ID_User_13130307 &EventToken=SCHEDULE

Réponse

mid=BNP_DEMO_AXEPTA &PayID=00000000000000000000000000000000 &scheduleinfo=20480;24/04/2023;5120;24/05/2023;5120;23/06/2023;5120;23/07/2023;5120 &Code=00000000 &Status=OK &Description=success &CodeExt=0 &errortext=Request successfully processed &MAC=2196D6D553359AC1A7F62593B1E3E297E433651CD2E4A82BC57621C62C182665

You will find in the field ''scheduleinfo="

<Total amount>;<Schedule date 1>;<Amount1>;<Schedule date 2>;<Amount 2>;<Schedule date 3>;<Amount 3>

The amount is always displayed in cents.

Technical documentation

You will find the technical integration details in the following section: FLOA Pay Direct Integration - Documentation Axepta BNP Paribas - Axepta

The FLOA Test contains test data as well as a step-by-step to perform a FLOA payment request

Recommendations

Standard case

You will find below the mandatory parameters to include in your request in order to calculate eligibility.

These parameters are used to calculate the customer score associated for each transaction.

| Paramètres | Description | Lien | Format minimal préconisé |

|---|---|---|---|

| Salutation | Gender | - | - |

| MaidenName | Maiden name - mandatory if Mrs Mrs | - | - |

| DateOfBirth | Date of birth | - | - |

| PlaceOfBirth | Birth Zip Code | - | - |

| CustomerHistory | Customer data | Customer History JSON Object | {

"firstOrderDate": "01/01/2023",

"lastOrderDate": "01/02/2023"

}

|

| ProductDetails | Customer cart data | Product Details JSON Object | {

"categorie1": "Categorie 1 de produit",

"categorie2": "Categorie 2 de produit"

}

|

Travel/Tourism

In addition, if the merchant has an activity related to tourism or travel, it is necessary to add the following parameters.

| Paramètres | Description | Lien | Format minimal préconisé |

|---|---|---|---|

| ProductDetails | Customer cart data | Product Details JSON Object | Use the following values :

{

"categorie1": "AIRLINE TICKET"

}

|

| TravelDetails | Travel parameter: airline tickets, passport information, etc. | Travel Details JSON Object | {

"insurance": "AXA",

"travelType": "TwoWay",

"departureDate": "21/11/2022 12:20",

"returnDate": "14/12/2022 12:20",

"destinationCountry": "FR",

"ticketCount": 2,

"travellerCount": 2,

"travelClass": "Economy",

"ownTicket": 1,

"mainDepartureCompany": "CDG",

"departureAirport": "cdg",

"arrivalAirport": "dub",

"luggageSupplement": "1"

}

|

| StayDetails | Hotel services parameter | Stay Details JSON Object | {

"company": "Ibis",

"destination": "Dublin",

"roomRange": 2

}

|

Country

Depending which countries you have contracted, additional mandatory parameters must be added.

You will find below a summary table listing the specific parameters for each country.

| Paramètres API AXEPTA | Belgium | Spain | Italy | Portugal |

|---|---|---|---|---|

| Language | nl-BE en-BE | es-ES | it-IT | pt-PT |

| AddrCountryCode | BE | ES | IT | PT |

| PersonID | NA | Mandatory | Mandatory | Mandatory |

You will find test PersonIDs in the section: Test FLOA

Testing

FLOA test recommendation and prerequisites

During your testing activities we invite you to check that:

- The MerchantIDExt and Paytype recipe fields are well informed.

- The value of the Amount field is between the minimum and maximum amount previously contracted

- The value of the Amount field is the amount valued in cents

- The ProductDetails and CustomerHistory fields contain base64-encoded JSON objects - Basics of Base64-encoding EN

- The AddrCountryCode parameter is populated

- The Language parameter corresponds to the country language

Production environnement

The steps for the deployment in production are :

- FLOA Functional validation

- FLOA's 'Professional Services' team, which supports the merchant FLOA implementation, carries out testing until payment for each solution integrated on the merchant site. All products will be tested.

- Ex: if the merchant has requested 3XG and 4XG, FLOA will do 1 test on the 3XG solution and 1 test on the 4XG solution.

- FLOA Marketing validation

- The FLOA Marketing team checking:

- All the visible highlights of FLOA and payment solutions along the customer journey

- The legal notices display and the merchant's general sales conditions

- Merchant Production Onboarding.

- The merchant opens FLOA on his website.

- The FLOA Marketing team checking: