Subscription compliant with PSD2 regulation

- First transaction (subscription initiation transaction) : Transaction strongly authenticated with 3DSV2 (SCA) without exemption request

- All subsequent transactions are linked to the first transaction

Key features

- Subscription for fixed amount and frequency The amount, frequency and duration are known when the customer suscribes

- Subscription for variable amount and/or frequency - CIT / MIT : in any other case, the amount, frequency or duration are not known at the time of subscription (tacit renewal).

Description

This section covers the implementation recurring card payments, compliant with PSD2, on Axepta Online for CB, VISA, Mastercard.

Axepta Online offers 2 kind of subscription :

- Subscription for a fixed amount and frequency over a defined period: The amount, frequency and duration are known when the customer suscribes

- Variable subscription - CIT / MIT : in any other case, the amount, frequency or duration are not known at the time of subscription (tacit renewal).

For recurring card payments with a first MOTO transaction, you can refere to Recurring card payments (Subscription) - MOTO (Mail Order / Telephone Order)

The kind of subscription must be defined during the first transaction and cannot be modified during subscription.

If you want to switch from a fixed-term subscription to a variable subscription, you will have to enroll your customer again (new CIT transaction - Customer Initiated Transaction - with 3DS authentication).

Prerequisites

Subscription / recurring payment by card (CB, Visa, Mastercard):

Choose which kind of subscription you will use (see below)

Get your client's consent for the subscription of a new subscription (on merchant side)

Store the following data

The JSON object Card containing: the tokenized card number (PCNr), the card brand and the expiration date

The schemeReferenceID received in response of the first transaction (subscription initiation transaction)

Subscription flows

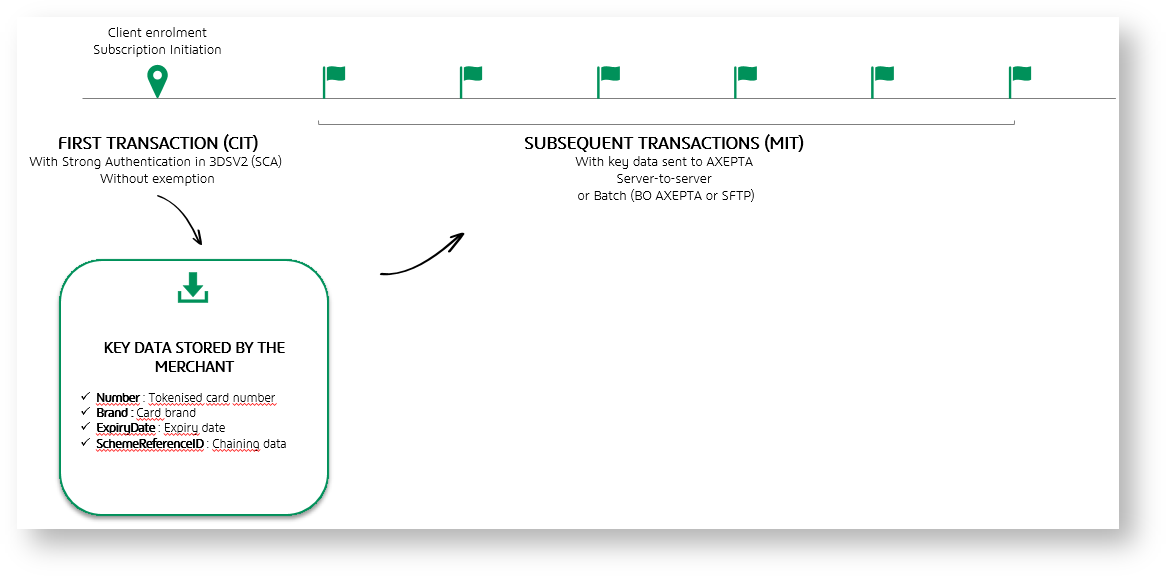

The subscription flows are :

- Client enrolement : subscription initiation transaction

The 1st transaction, initiated by the client, will be authenticated with 3DSV2. It's a CIT or Customer Initiated transaction.

This transaction will not be eligible to an exemption request.

A chaining value will be sent in the response of this transaction. It will be stored by the merchant and used in all subsequent transactions (see diagram below).

- Subsequent transactions

- The subsequent transactions will be initiated by the merchant. It's an MIT or Merchant Initiated transaction.

The requests will use the chaining value received in response of the subscription initiation transaction.

- The subsequent transactions will be initiated by the merchant. It's an MIT or Merchant Initiated transaction.

Subscription flows

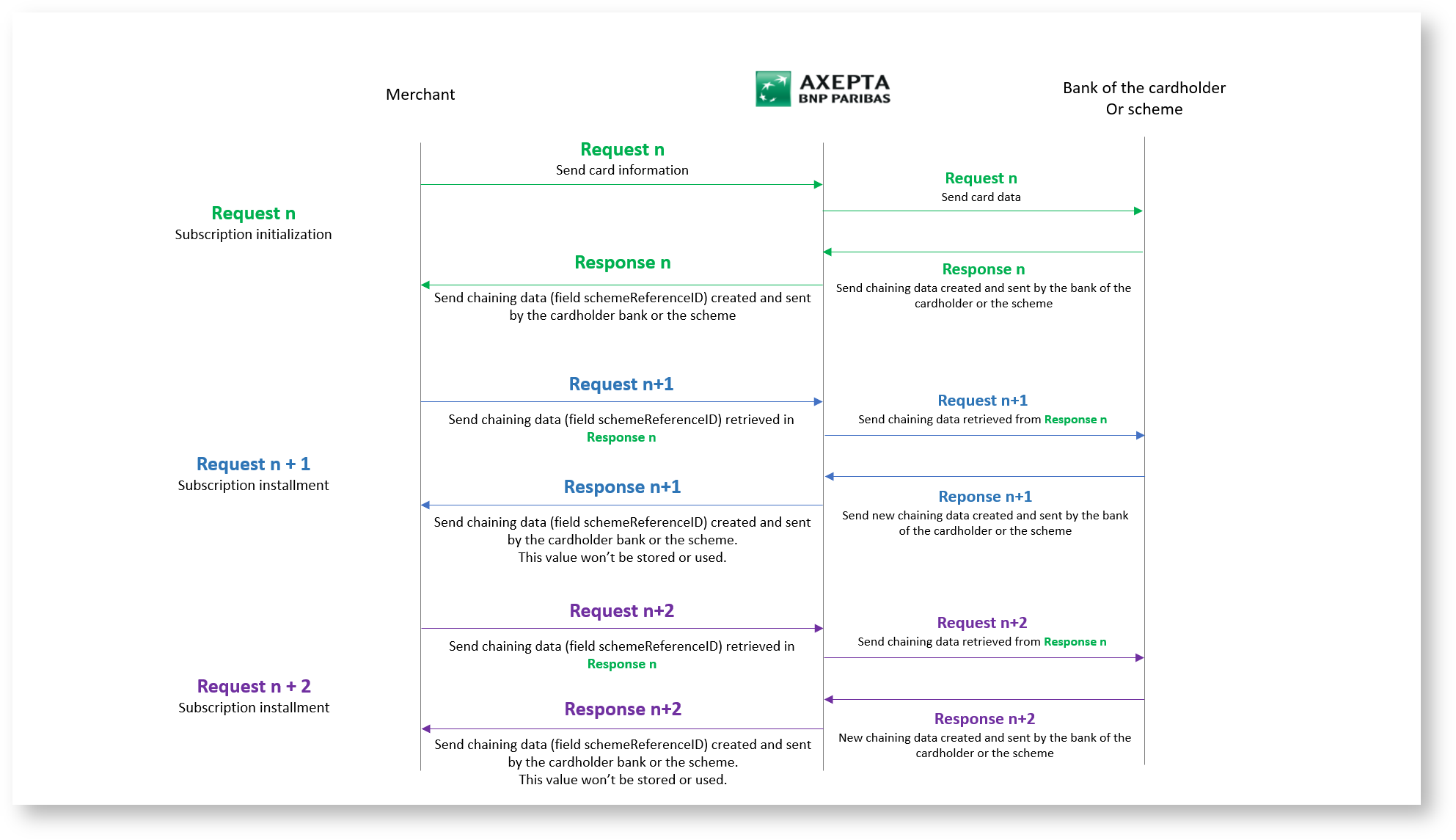

Focus on transactions chaining

A key data

The reponse of 1st transaction of a subscription will contain the chaining data which will be used to link ("chain") the subsequent transaction to the 1st transaction (initiation of the subscription).

The chaining data, received in response to the subscription initialization, is generated either by the bank or by the scheme (Visa, Mastercard).

In the Axepta Online documentation, the chaining data is called schemeReferenceID.

Principles

Transactions chaining

Subscription implementation

Subscription for a fixed amount and frequency

Subscription for variable amount and/or frequency - CIT / MIT

Subscription with AMEX cards

The recurring card payments, compliant with PSD2, on Axepta Online for AMEX require to use parameter TransactionID instead of schemeReferenceID (request and response).