A subscription compliant with regulations (PSD2)

- First Subscription Installment: Strongly authenticated transaction in 3DSV2 (SCA) without exemption request

- Linking subsequent installments to the first subscription installment

Key Features

- Fixed amount and frequency Subscription for a defined duration

- Variable Amount and/or Frequency Subscription (CIT/MIT)

Description

This section explains how to implement card subscriptions that comply with PSD2 regulations on Axepta Online for CB, VISA, and Mastercard cards.

Axepta Online supports two types of subscriptions:

Fixed Amount and Frequency Subscription for a defined duration: The amount, frequency, and duration are known at the time of subscription

Variable Subscription (CIT/MIT): For cases where the amount, frequency or duration are not known at the time of subscription (tacit renewal)

The subscription type must be determined at the time of enrollment and cannot be changed during the subscription period.

If you wish to switch from a fixed-duration subscription to a variable subscription, you will need to re-enroll your customer (new CIT - Customer Initiated Transaction - with 3DS authentication).

Prerequisites

- For subscription/recurring payments by card (CB, Visa, Mastercard):

- Choose which kind of subscription you will use (see below)

- Obtain your client's consent for the new subscription (on merchant side)

- Store the following data:

- The JSON object Card containing: The tokenized card number (PCNr), The card brand, The expiration date

- The schemeReferenceID received in response to the first transaction (subscription initiation transaction)

First payment

The information for the recurring payment request is passed through the JSON object "credentialOnFile".

Example of a recurring payment request with a fixed amount debit, every day, starting on November 7 and ending on November 20.

{

......

"credentialOnFile" : {

"type" : "RECURRING",

"initialPayment": true,

"recurring" : {

"useCase" : "FIXED",

"frequency" : "DAILY",

"startDate" : "2025-11-07",

"expiryDate" : "2025-11-20"

}

},

......

}

Once the first payment is accepted, the data needed for subsequent payments are available in the response to the transaction status request query

(API documentation link: Retrieve payment details by Payment ID ou Retrieve payment details by Transaction ID)

The data to be saved are:

- The tokenized card number: the parameter 'pseudoCardNumber'

- The scheme Reference ID: the parameter 'schemeReferenceId'

This data must be presented in subsequent requests:

Example: Following the previous request for recurring payment, one of the daily payments:

{

......

"credentialOnFile": {

"type" : "RECURRING",

"initialPayment": false,

"recurring" : {

"useCase" : "FIXED",

"frequency" : "DAILY",

"startDate" : "2025-11-07",

"expiryDate" : "2025-11-20"

}

},

"paymentMethods": {

"integrationType": "HOSTED",

"type" : "Card",

"card" : {

"brandSelection": "MERCHANT", // "CUSTOMER" ou "MERCHANT"

"prefillInfo": {

"number": "0701953701953810", // {{PCnrForStoredCredentials}}

"securityCode": "123",

"expiryDate": "203003",

"cardHolderName": "{{firstName}} {{lastName}}",

"brand" : "VISA"

},

"schemeReferenceId" : "1123456"

}

}

......

}

Subscription flows

The subscription setup process involves two main steps:

Customer Enrollment: Subscription Initialization at First Due Date

- The first transaction, initiated by the customer, will be authenticated using 3DSV2. This is referred to as a CIT (Customer-Initiated Transaction).

- This transaction will not be eligible for 3DS authentication exemption.

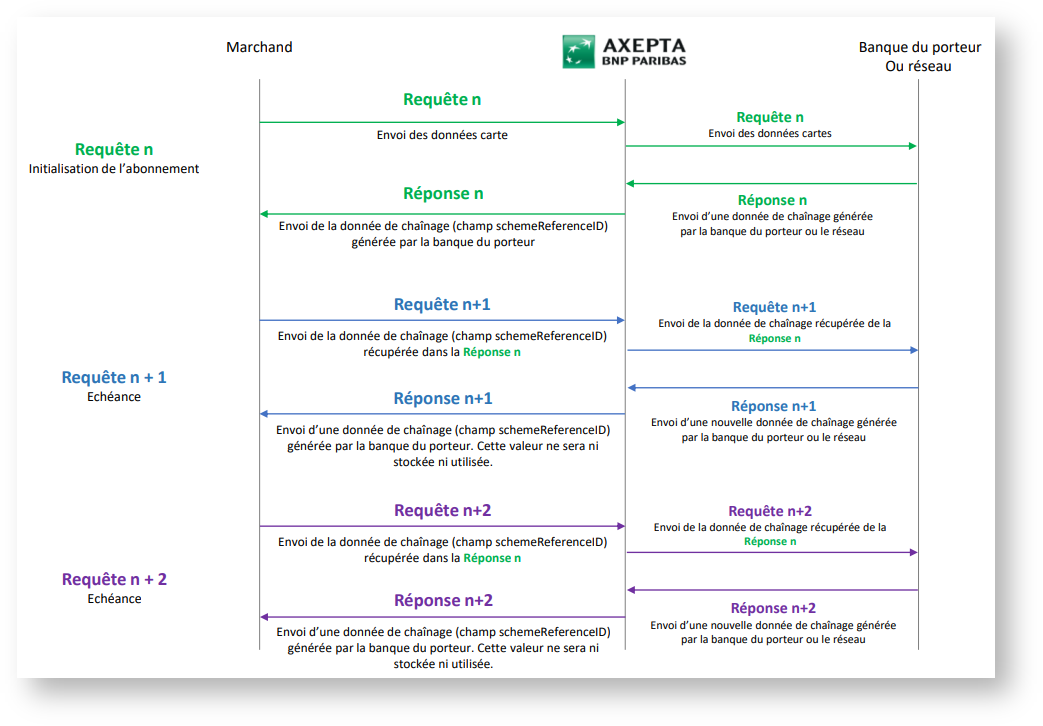

- A chaining value will be included in the transaction response. This value must be stored by the merchant and used for all subsequent subscription payments (see diagram below).

Subsequent Subscription Payments

- Subsequent payment requests will be initiated by the merchant. These are referred to as MIT (Merchant-Initiated Transactions).

- These requests will include the chaining value received in response to the subscription initialization transaction.

Subscription flows

Focus : Chaînage des transactions

Une donnée clé

La 1ère échéance d'un abonnement permet de récupérer une donnée de chaînage qui sera utilisée pour relier ("chaîner") les échéances suivantes à cette 1ère échéance.

La donnée de chaînage, reçue en réponse de l'échéance d'initialisation de l'abonnement, est générée soit par la banque du porteur soit par le scheme utilisé (Visa, Mastercard).

Dans la documentation Axepta Online, la donnée de chaînage est renseignée dans le paramètre schemeReferenceID.

Principes

Chaînage des transactions d'un abonnement

Implémentation de l'abonnement

Abonnement d'un montant et d'une périodicité fixes sur une durée définie

Abonnement d'un montant et/ou d'une périodicité variable - CIT / MIT

Abonnement avec des cartes AMEX

Les abonnements par carte, conformes à la DSP2, sur Axepta Online pour les cartes AMEX nécessite l'usage du paramètre TransactionID à la place du paramètre schemeReferenceID (requête et réponse).