The minimum amount for CV Connect transactions is 20 euros.

More details : CGV | Agence Nationale pour les Chèques Vacances (ancv.com)

About ANCV Connect

General information about ANCV Connect

Cheque-Vacances Connect (cvconnect by ANCV) is a French initiative for travel vouchers. The customer pays for travel (related) expenses with travel vouchers at accredited merchants.

On the payment page the customer declares paper check numbers and pays the remaining amount with his credit card. Authorisation is made on the card to guarantee the amount paid with Chèque-Vacances. Then the client must send his paper checks by mail. Additional payments are debited immediately.

- Integration requirement / specificities: The part paid by Chèque-Vacances can't be refunded. The merchant will be notified by email to find another solution to refund his clients.

- Authorisation and payment:

1-step payment for payments in addition to payment with Chèque-Vacances.

2-step payment in case of doubt about the guarantee on credit card or in case the paper checks don't arrive.

| Info | Only in France. |

|---|

Further information can be found on the webpage of ANCV (https://www.ancv.com/).

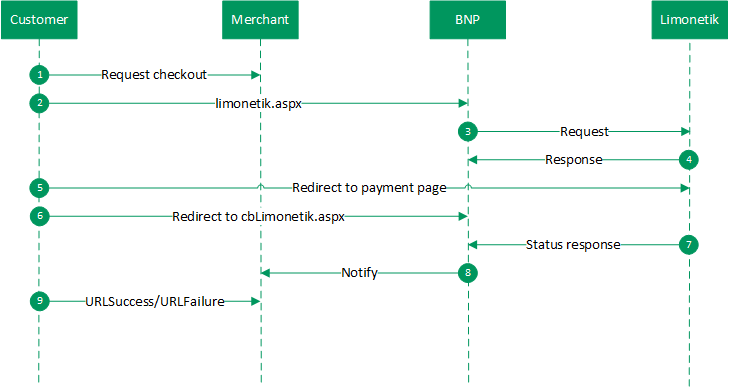

Process flow chart

The payment platform interface

Definitions

Data formats:

a | alphabetical |

as | alphabetical with special characters |

n | numeric |

an | alphanumeric |

ans | alphanumeric with special characters |

ns | numeric with special characters |

bool | boolean expression (true or false) |

3 | fixed length with 3 digits/characters |

..3 | variable length with maximum 3 digits/characters |

enum | enumeration of allowed values |

dttm | ISODateTime (YYYY-MM-DDThh:mm:ss) |

Abbreviations:

CND | condition |

M | mandatory |

O | optional |

C | conditional |

Notice: Please note that the names of parameters can be returned in upper or lower case.

Call of the payment platform interface for ANCV Connect

To make a payment with ANCV Connect via Limonetik over the payment platform, go to the following URL:

Notice: For security reasons, the payment platform rejects all payment requests with formatting errors. Therefore please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

Parameter | Format | CND | Description | |

|---|---|---|---|---|

MerchantID | ans..30 | M | MerchantID, assigned by BNP Paribas. Additionally this parameter has to be passed in plain language too. | |

TransID | ans..64 | M | TransactionID which should be unique for each payment | |

RefNr | ans..30 | O | Unique reference number | |

Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent) Please contact the helpdesk, if you want to capture amounts < 100 (smallest currency unit). | |

TaxAmount | n..12 | O | Tax amount of the entire order in the smallest currency unit (e.g. EUR Cent). | |

Currency | a3 | M | Currency, three digits DIN / ISO 4217 | |

MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm | |

OrderDesc | ans..128 | O | Description of purchased goods, unit prices etc. | |

Capture | ans..6 | O | Determines the type and time of capture. AUTO: capturing immediately after authorisation (default value). MANUAL: capturing made by the merchant. <Number>: Delay in hours until the capture (whole number; 1 to 696). Important Note: Please contact the BNP Paribas Support to discuss the different fields of application for Manual. | |

URLSuccess | ans..256 | M | Complete URL which calls up the payment platform if payment has been successful. The URL may be called up only via port 443 This URL may not contain parameters: In order to exchange values between the payment platform and shop, please use the parameter UserData. | |

URLFailure | ans..256 | M | Complete URL which calls up the payment platform if payment has been unsuccessful. The URL may be called up only via port 443 This URL may not contain parameters: In order to exchange values between the payment platform and shop, please use the parameter UserData. | |

Response | a7 | O | Status response sent by the payment platform to URLSuccess and URLFailure, should be encrypted. For this purpose, transmit Response=encrypt parameter. | |

URLNotify | ans..256 | M | Complete URL which the payment platform calls up in order to notify the shop about the payment result. The URL may be called up only via port 443 It may not contain parameters: Use the UserData parameter instead. | |

UserData | ans..1024 | O | If specified at request, the payment platform forwards the parameter with the payment result to the shop | |

ReqID | ans..32 | O | To avoid double payments, enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction is submitted again with the same ReqID, the payment platform will not carry out the payment, but will just return the status of the original transaction. Please note that the payment platform must have a finalized transaction status for the first initial action. Submissions with identical ReqID for an open status will be processed regularly. | |

PayType | ans..21 | M | Payment method that shall be used. Possible values: cvconnect | |

Invoicing address | ||||

CompanyName | ans..50 | C | Company name, if shop delivery, StorePickup, Network-Pickup or TravelPickup is selected | |

CustomerID | ans..20 | O | Customer number | |

CustomerClassification | a..12 | O | Hint about customer type. Possible values: Professional, Individual | |

CustomerInformation | ans..100 | O | Additional information about the customer. For Cetelem the merchant can submit several values separated by | which are agreed between merchant and Cetelem. Example: CustomerInformation =CFID=true|CNEW=false | |

Salutation | ans..20 | O | Salutation | |

FirstName | ans..50 | O | First name | |

LastName | ans..50 | O | Last name | |

Street | ans..80 | O | Street name and street number | |

AddressAddition | ans..80 | O | Address c/o | |

ZIPCode | ans..10 | O | Postcode | |

City | ans..100 | O | City | |

CountryCode | a2 | M | Two characters country code according to ISO 3166-1 alpha-2 FR for FRANCE This data is mandatory because it's used for the top-up payment by card. Without this data, the payment will fail | |

ans..100 | M | E-mail address | ||

Phone | ns..50 | O | Phone number e.g. +49123456789 | |

MobileNo | ns..50 | M | Mobile phone number e.g. +49123456789 | |

Language | as5 | O | Language for displaying the form. Default value: fr-FR | |

Delivery address | ||||

sdCompanyName | ans..50 | O | Company name in the delivery address | |

sdSalutation | ans..20 | O | Salutation in the delivery address | |

sdFirstName | ans..50 | O | First name in the delivery address | |

sdLastName | ans..50 | O | Last name in the delivery address | |

sdStreet | ans..80 | O | Street name and street number in the delivery address | |

sdAddressAddition | ans..80 | O | Address addition in the delivery address | |

sdZipCode | ans..10 | O | Postcode in the delivery address | |

sdCity | ans..100 | O | Town/city in the delivery address | |

sdCountryCode | a2 | O | Country code for the delivery address, 2 characters according to ISO 3166-1. | |

sdPhone | ans..50 | O | Phone number e.g. +49123456789 | |

sdMobileNo | ans..50 | O | Mobile phone number e.g. +49123456789 | |

Product information | ||||

ArticleList | ans..1024 | C | Article list. These parameters must have the following structure: ID,Description,UnitPrice,Quantity,Category,Brand Several articles can be separated with a +, e.g.: 123,iPhone 6s,700,1,Phones,Apple+321,Galaxy S7,700,2,Phones,Samsung Possible values for Category: • ComputersAndSoftware • Electronics • Phones • Appliances • HomeAndGarden • Fashion • HealthAndBeauty • Jewellery • Sport • LeisureAndHobbies • CarsAndMotorbikes • Furniture • KidsAndBaby • VideoGamesAndConsoles • ToysAndGames • Pets • FoodAndDrink • GiftAndFlowers • Entertainment • Travel • AuctionsAndGroupBuying • ServicesForIndividuals • ServicesForProfessionals | |

ShippingData | ans..1024 | C | Delivery data. These parameters must have the following structure: Type,Description,Speed,ExpectedDate,ExpectedDelay e.g.: Other,DHL,Standard,2016-06-30,3 Possible values for Type: • StorePickup • NetworkPickup • TravelPickup • Carrier • EDelivery • Other Possible values for Speed: • Express • Standard | |

The following table describes the result parameters that the payment platform transmits to your URLNotify, URLSuccess or URLFailure. If you have specified the Response=encrypt parameter, the following parameters are forwarded Blowfish encrypted to your system:

MID | ans..30 | M | MerchantID, assigned by BNP Paribas |

PayID | an32 | M | ID assigned by the payment platform for the payment, e.g. for referencing in batch files. |

XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the payment platform |

TransID | ans..64 | M | Merchant’s transaction number |

RefNr | ns..30 | O | Unique reference number |

MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm |

Status | a..50 | M | OK or FAILED |

Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

Code | n8 | M | Error code according to the payment platform Response Codes (Error codes) |

CodeExt | ans..256 | C | Error code from Limonetik. Notice: Is returned only if Status=FAILED. Use is possible only in agreement with BNP Paribas support. |

ErrorText | ans..256 | C | Detailed Limonetik error message. Notice: Is returned only if Status=FAILED. Use is possible only in agreement with BNP Paribas support. |

UserData | ans..1024 | O | If specified at request, the payment platform forwards the parameter with the payment result to the shop |

TransactionID | ans..50 | O | ID for identification of payment form |

Capture

Captures are possible via a Server-to-Server connection. To carry out a Capture for ANCV Connect via Limonetik via a Server-to-Server connection please use the following URL:

Notice: For security reasons, the payment platform rejects all payment requests with formatting errors. Therefore please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

MerchantID | ans..30 | M | MerchantID, assigned by BNP Paribas. Additionally this parameter has to be passed in plain language too. |

PayID | an32 | M | ID assigned by the payment platform for the payment to be captured |

TransID | ans..64 | M | TransactionID which should be unique for each payment |

Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent) Please contact the helpdesk, if you want to capture amounts < 100 (smallest currency unit). |

Currency | a..3 | M | Currency code, three digits DIN / ISO 4217 |

RefNr | ns..30 | O | Merchant’s unique reference number |

MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm |

| ReqID | ans..32 | O | To avoid double payments, enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction is submitted again with the same ReqID, the payment platform will not carry out the payment, but will just return the status of the original transaction. Please note that the payment platform must have a finalized transaction status for the first initial action. Submissions with identical ReqID for an open status will be processed regularly. |

The following table describes the payment platform response parameters:

MID | ans..30 | M | MerchantID, assigned by BNP Paribas |

PayID | an32 | M | ID assigned by the payment platform for the payment, e.g. for referencing in batch files. |

XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the payment platform |

TransID | ans..64 | M | Merchant’s transaction number |

Status | a..50 | M | OK or FAILED |

Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

Code | n8 | M | Error code according to the payment platform Response Codes (Error codes) |

RefNr | ns..30 | M | Merchant’s unique reference number |

Credit with reference

Credits (refunds) are possible via a Server-to-Server connection. For a Credit with reference to a capture the amount of the Credit is limited to the amount of the previous capture. To carry out a credit with a reference transaction, please use the following URL:

Notice: For security reasons, the payment platform rejects all payment requests with formatting errors. Therefore please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

MerchantID | ans..30 | M | MerchantID, assigned by BNP Paribas. Additionally this parameter has to be passed in plain language too. |

PayID | an32 | M | ID assigned by the payment platform for the payment to be credited |

TransID | ans..64 | M | TransactionID which should be unique for each payment |

Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent) Please contact the helpdesk, if you want to capture amounts < 100 (smallest currency unit). |

Currency | a..3 | M | Currency code, three digits DIN / ISO 4217 |

MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm |

| ReqID | ans..32 | O | To avoid double payments, enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction is submitted again with the same ReqID, the payment platform will not carry out the payment, but will just return the status of the original transaction. Please note that the payment platform must have a finalized transaction status for the first initial action. Submissions with identical ReqID for an open status will be processed regularly. |

The following table describes the payment platform response parameters:

MID | ans..30 | M | MerchantID, assigned by BNP Paribas |

PayID | an32 | M | ID assigned by the payment platform for the payment, e.g. for referencing in batch files. |

XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the payment platform |

TransID | ans..64 | M | Merchant’s transaction number |

Status | a..50 | M | OK or FAILED |

Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

Code | n8 | M | Error code according to the payment platform Response Codes (Error codes) |

Reversal

To cancel a transaction with ANCV Connect via Limonetik, please use the following URL:

Notice: For security reasons, the payment platform rejects all payment requests with formatting errors. Therefore please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

MerchantID | ans..30 | M | MerchantID, assigned by BNP Paribas. Additionally this parameter has to be passed in plain language too. |

PayID | an32 | M | ID assigned by the payment platform for the payment to be reverted |

TransID | ans..64 | M | TransactionID which should be unique for each payment |

Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent) Please contact the helpdesk, if you want to capture amounts < 100 (smallest currency unit). |

Currency | a..3 | M | Currency code, three digits DIN / ISO 4217 |

MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm |

| ReqID | ans..32 | O | To avoid double payments, enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction is submitted again with the same ReqID, the payment platform will not carry out the payment, but will just return the status of the original transaction. Please note that the payment platform must have a finalized transaction status for the first initial action. Submissions with identical ReqID for an open status will be processed regularly. |

The following table describes the payment platform response parameters:

MID | ans..30 | M | MerchantID, assigned by BNP Paribas |

PayID | an32 | M | ID assigned by the payment platform for the payment, e.g. for referencing in batch files. |

XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the payment platform |

TransID | ans..64 | M | Merchant’s transaction number |

Status | a..50 | M | OK or FAILED |

Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

Code | n8 | M | Error code according to the payment platform Response Codes (Error codes) |

Batch processing via the interface

Basic information about using Batch files and about their structure you can find inside the separate manual for the Batch manager. Within batch processing not alle functions are available which are usually available for the online interface.

This section describes the parameters which must be transferred within the data set (Record) for executing of captures, credits and reversals for ANCV Connect via Limonetik and which information can be found within the response file about the payment status.

Following table gives an overview of all batch versions that are possible for a specific action an their specialities:

Capture | 1.0 / 2.0 | Standard version without return of parameter Code |

| 1.x / 2.x | with RefNr (valid for all versions other than 1.0) |

Credit | 1.0 / 2.0 | Standard version without return of parameter Code |

| 1.x / 2.x | with RefNr (valid for all versions other than 1.0) |

Reverse | 1.0 / 2.0 | Standard version without return of parameter Code |

| 1.x / 2x. | with RefNr (valid for all versions other than 1.0) |

The structure for a Limonetik payment within a Batch file to be submitted is the following:

HEAD,<MerchantID>,<Date>,<Version> Limonetik,Capture,<Amount>,<Currency>,<TransID>,(<RefNr>,)<PayID> Limonetik,Credit,<Amount>,<Currency>,<TransID>,(<RefNr>,)<PayID> Limonetik,Reverse,<Amount>,<Currency>,<TransID>,(<RefNr>,)<PayID> FOOT,<CountRecords>,<SumAmount> |

Example for Master MID Funktion:

| HEAD,[Master]MerchantID,Date,2.x Type,Action,[Slave]MID,Amount,Currency,TransID,Data (depends on Action) FOOT,CountRecords,SumAmount |

The following table describes the individual fields and values used within the data set (record) in the batch file:

Type | a..11 | M | HEAD for Header, FOOT for Footer, Limonetik for Limonetik |

Action | a..20 | M | The parameter Action defines the type of transaction: Capture Credit Reverse (cancellation) |

Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent) Please contact the helpdesk, if you want to capture amounts < 100 (smallest currency unit). |

Currency | a3 | M | Currency code, three digits DIN / ISO 4217 |

TransID | ans..64 | M | TransactionID which should be unique for each payment |

RefNr | ns..30 | O | Unique reference number |

PayID | an32 | M | ID for this transaction given by the payment platform |

The record area within the response file for Batch transactions looks the following way:

HEAD,<MerchantID>,<Date>,<Version> Limonetik,Capture,<Amount>,<Currency>,<TransID>,(<RefNr>,)<PayID>,<Status>,<Code> Limonetik,Credit,<Amount>,<Currency>,<TransID>,(<RefNr>,)<PayID>,<Status>,<Code> Limonetik,Reverse,<Amount>,<Currency>,<TransID>,(<RefNr>,)<PayID>,<Status>,<Code> FOOT,<CountRecords>,<SumAmount> |

The following table describes the response parameters which the Batch Manager saves in the Record area for each transaction (standard parameters not explained here, such as <TransID> or <RefNR> and request parameters are returned unchanged and correspond to the call as specified before):

Action | a..20 | M | The parameter Action defines the type of transaction: Capture Credit Reverse (cancellation) |

PayID | an32 | M | ID for this transaction given by the payment platform |

Status | a..50 | M | OK or FAILED |

Code | n8 | M | Error code according to the payment platform Response Codes (Error codes) |