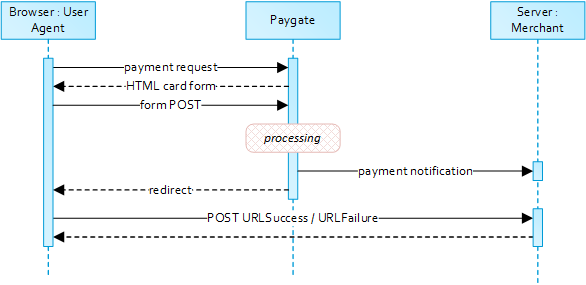

Payment Request

To retrieve a

card form please submit the following data elements via HTTP POST request method to Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Partner-Name PageWithExcerpt Wording

payssl.aspx.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName BaseURL PageWithExcerpt Wording

| Table Filter | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

will return an HTML document in the response body representing the requested card form. The form may be included in the merchant checkout page or used as a standalone page to redirect the cardholder to.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

| Multiexcerpt | ||||

|---|---|---|---|---|

| ||||

Cardholder authentication and payment authorization will take place once the the cardholder entered all required card details and submitted the form data to

.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

Note: In case you are using your own templates (Corporate Payment Page), please make sure you include Cardholder name on your custom template. Cardholder name is mapped to

API parameter "CreditCardHolder". Cardholder name field must not contain any special characters and must have minimal length of 2 characters and maximum length of 45 characters.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

When the payment is completed

will send a notification to the merchant server (i.e. URLNotify) and redirect the browser to the URLSuccess resepctively to the URLFailure.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

The blowfish encrypted data elements as listed in the following table are transferred via HTTP POST request method to the URLNotify and URLSuccess/URLFailure.

|

will return an HTML document in the response body representing the requested card form. The form may be included in the merchant checkout page or used as a standalone page to redirect the cardholder to.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

| Multiexcerpt | ||||

|---|---|---|---|---|

| ||||

Cardholder authentication and payment authorization will take place once the the cardholder entered all required card details and submitted the form data to

.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

Note: In case you are using your own templates (Corporate Payment Page), please make sure you include Cardholder name on your custom template. Cardholder name is mapped to

API parameter "CreditCardHolder". Cardholder name field must not contain any special characters and must have minimal length of 2 characters and maximum length of 45 characters.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

When the payment is completed

will send a notification to the merchant server (i.e. URLNotify) and redirect the browser to the URLSuccess resepctively to the URLFailure.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

The blowfish encrypted data elements as listed in the following table are transferred via HTTP POST request method to the URLNotify and URLSuccess/URLFailure.

| Note |

|---|

| Notice: Please note that the call of URLSuccess or URLFailure takes place with a GET in case of fallback to 3-D Secure 1.0. Therefore your systems should be able to receive parameters both via GET and via POST. |

The following table gives the result parameters which Axepta Platform transmits to URLSuccess or URLFailure and URLNotify. If you have specified the Response=encrypt parameter, the following parameters are sent Blowfish encrypted to your system:

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

ans..30 | M | MerchantID, assigned by BNP | |

| PayID | an32 | M | ID assigned by Platform for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by Platform |

| Code | an8 | M | Error code according to Platform Response Codes (A4 Error codes) |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

TransID | ans..64 | M | TransactionID which should be unique for each payment Please note for some connections the different formats that are given within the specific parameters. |

Status | a..50 | M | OK or AUTHORIZED (URLSuccess) as well as FAILED (URLFailure) |

an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HashMAC-Authentication. | |

| UserData | ans..1024 | O | If specified at request, Platform forwards the parameter with the payment result to the shop. |

MaskedPan | an..19 | OC | Masked card number 6X4. If you want to receive the parameter MaskedPan, please contact Axepta Helpdesk, which can activate the return. |

TransID | ans..64 | M | TransactionID which should be unique for each payment Please note for some connections the different formats that are given within the specific parameters. |

CAVV | ans..40 | OC | In the case of 3-D Secure with Authentication Hosting (only 3-D request without authorisation): Cardholder Authentication Validation Value: Contains the digital signature for authentication with the ACS of the card issuing bank. |

| Plain | ans..50 | O | A value to be set by the merchant to return some information unencrypted, e.g. the MID |

| Custom | ans..1024 | O | The merchant can submit several values separated by | which are returned unencrypted and separated by &. Custom=session=123|id=456 will change in the answer to Session=123&id=456 |

| CustomField[n] | ans..50 | O | Field that can be used individually by the merchant. Presently 14 fields from CustomField1 to CustomField14 are supported. |

HTTP POST to URLSuccess / URLFailure / URLNotify

| Table Filter | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

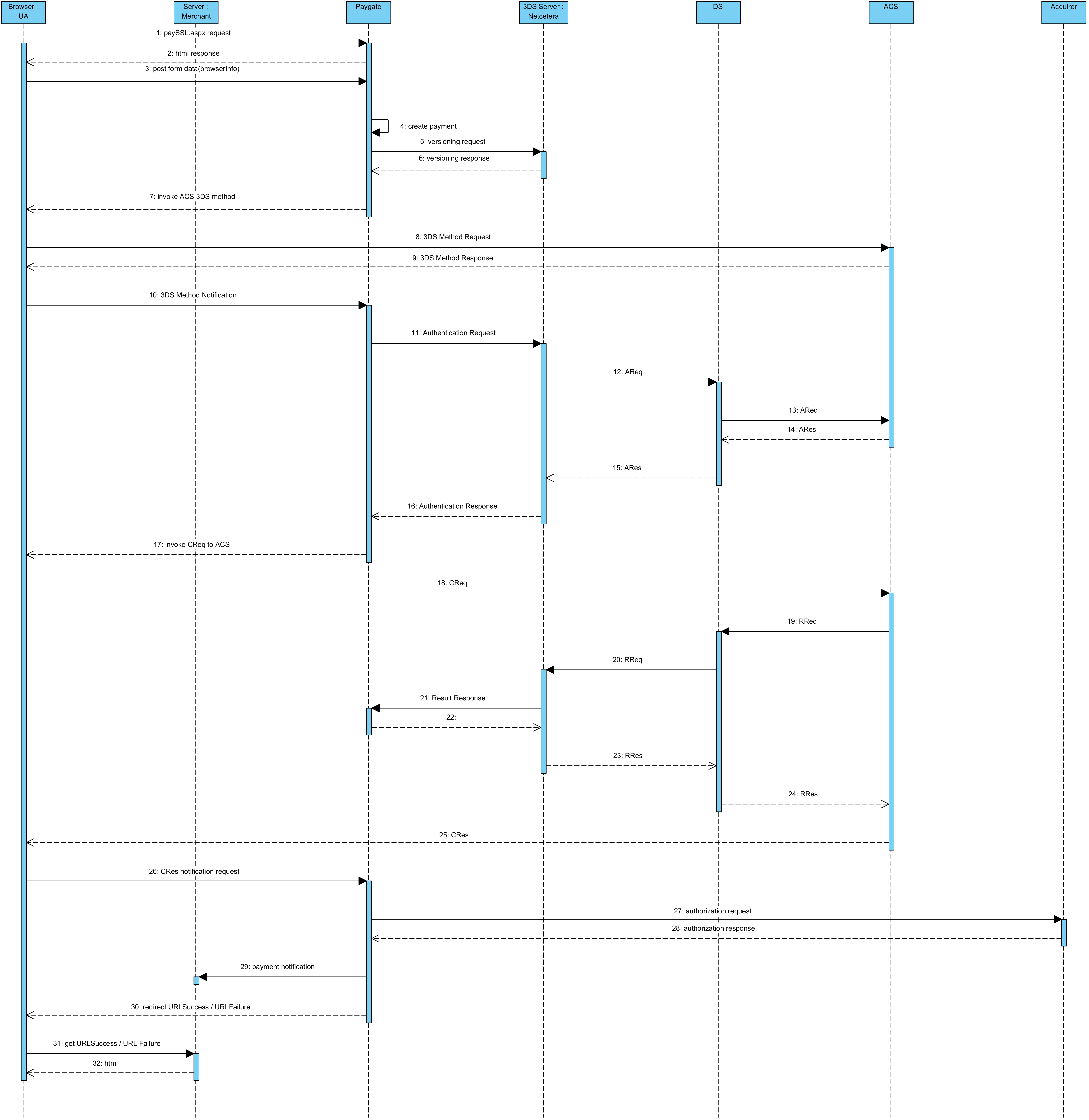

Extended Sequence Diagram

| Multiexcerpt | ||||

|---|---|---|---|---|

| ||||