| Table of Contents |

|---|

Preamble

By subscribing to the AXEPTA BNP Paribas solution, each merchant will have access to the AXEPTA Back Office. Access as a “super-administrator” is automatically created to a contact defined by the merchant and mentioned in the subscription form. A super-administrator will therefore have all the rights including the right to create other users and assign them rights as well (the exhaustive list will be presented later).

...

The number is free from France and the support team is available from 8 AM to 10 PM (local time) from Monday to Friday.

Backoffice presentation

The Axepta Back Office is a web app which offers an overview and control over all transactions of a merchant. The Back Office is compatible with most web browsers; however it is recommended to use Chrome and Firefox (Safari currently not available).

...

- Must not be used more than once

- Must be between 8 and 20 characters

- Contains at least one number, one special character and one capital letter.

Transaction Management

The section “Transactions” allows the merchant to see and manage all their transactions.

...

Transactions

When the merchant wishes to consult their transactions, it is possible to filter them according to different criteria:

...

Note that the MasterID cannot be used to carry out transactions but only to visualize the global activity of the merchant

...

Details of operations

Inside “Transaction details “, the merchant will have a more complete visibility on his transactions with additional columns such as:

...

In order to partially capture an amount, the user will have to enter the amount that is to be captured (less than the total amount of the transaction) in the “amount” section and click on “remit” to partially remit the transaction to the bank.

...

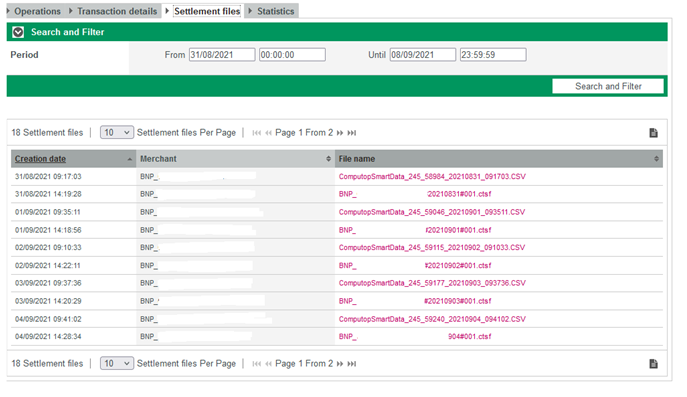

Settlement file

The settlement file is used to meet merchant’s bank settlement needs. It gathers the data from the various payment service providers or acquires. The file is available and can be downloaded in CSV format (all the values are separated by commas). The file is generated daily (at about 3 PM).

The merchant can select a specific period (up to 60 days) in the “settlement file” section, to filter the results.

...

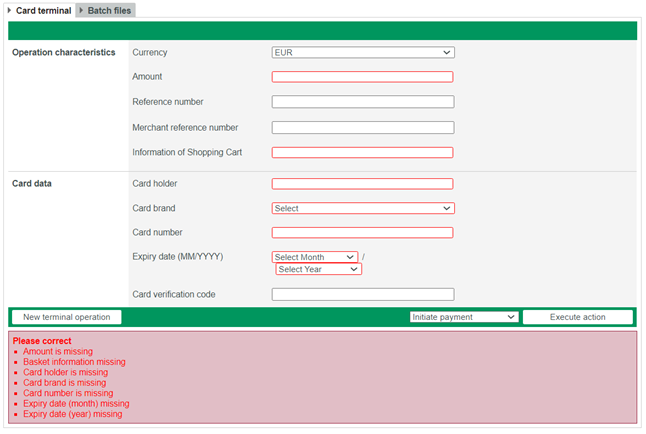

Creation of a transaction

The merchant can manually create a payment from his Back Office (Mail Order Telephone Order = MoTo), he must enter the characteristics of the transaction:

...

Please note that some sections are mandatory (sections in red below).

...

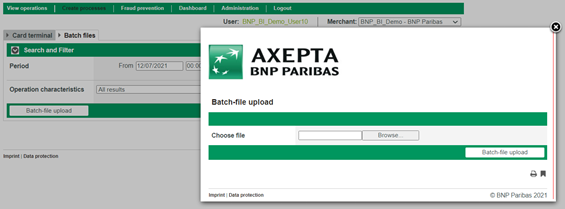

Batch Files

It is possible to manually transmit payment transactions in the form of files.

...

In the Back Office, simply go to the “Create transactions” section and then “Batch files”.

...

Dashboard

The “dashboard” section allows the merchant to analyze their transactions and evaluate their performance in order to improve their conversion rate.

...

- Key figures

- Analysis of operations

- Transaction status

- Trend analysis

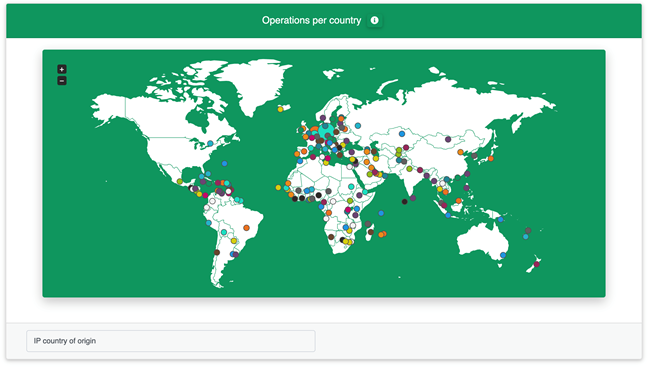

- Analysis by country

...

Key figures

The graphs proposed in this section allow you to visualize the merchant’s performance index (Key Performance Indicator = KPI).

...

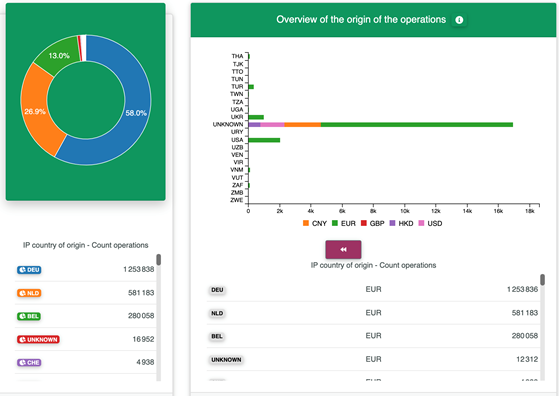

The merchant can also consult an overview of the geographical origin of his transaction in a dynamic map (it is possible to define the criteria of origin: IP address and country of issue of the card).

...

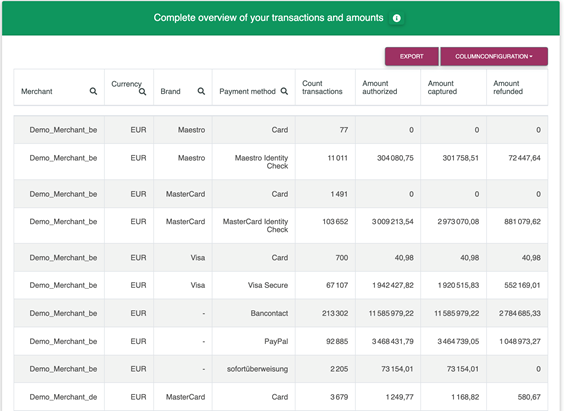

Analysis of operations

This section goes through the breakdown of the merchant’s operations by payment method for a given currency.

...

To consult more details about the transactions, the merchant can choose the columns of the data he wants to see and can export the obtained result.

...

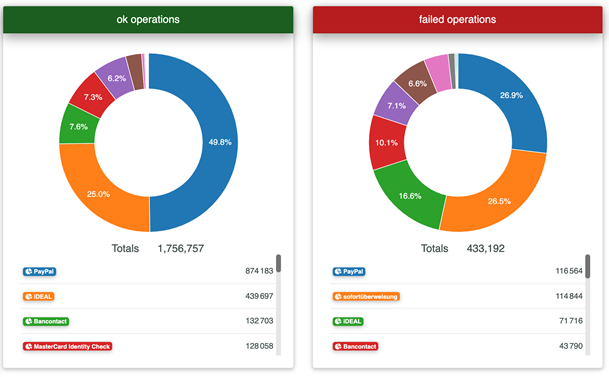

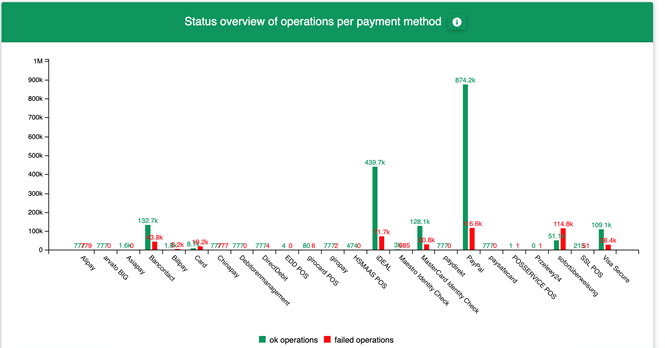

Transaction status

This section shows the number of transactions according to the statuses (success / fail) and according to the form of payment. The merchant can also analyze the rejections with the associated return codes (time out/ invalid value/ invalid card/ amount mistmatch/ etc) by transaction and by form of payment.

...

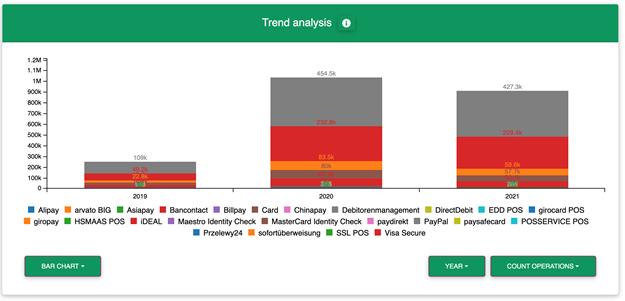

Trend analysis

This overview shows a trend over time about the revenue by form of payment or by currency on a given period. The merchant can use the filters placed on the left to refine this analysis.

...

Analysis by country

This section details the breakdown of the merchant’s transactions by country and currency.

The merchant can select a country and a currency in the filters under the diagrams.

Fraud prevention

The merchant can go to the “Fraud prevention” section in the Back Office to manually manage the black lists and white lists. That is, the solution allows to block suspicious customers (in a black list) and to list trusted customers (white list).

...

- Control of the origin of the card used by the buyer: Crimea/Sevastopol, Cuba, North Korea, Iran, Syria

- Control of the origin of the buyer’s IP address: Crimea/Sevastopol, Cuba, North Korea, Iran, Syria

- Control of the number of card transactions in 24 hours: 4 transactions

- Control of the number of cards for the same IP address in 24 hours: 3 cards

- Control of the amount of transactions per IP address in 24 hours: €3,000

- Control of the number of email address per user account in 24 hours: 4 email address

- Control of the number of transactions per IP address in 24 hours: 4 transactions

- Consistency check IP origin – card origin: enabled

Blac klist/white list | Blac klist/white list SecurePay | |

Supplying the list | · Manual by the merchant. | · Automatic by the Axepta solution according to the criteria predefined by the merchant (anti-fraud rules) |

Action by the merchant | · Adding card number (token), IBAN, device ID… · Adding a CSV file · Removing an entry from the list · Consultation | · Consultation · Disabling/enabling a blocking |

...

Blacklists

To protect against payments with fraudulent cards, the merchant can add a new card (token), an IBAN or the device ID to the black list to prevent the holder from making a transaction.

...

It is also possible for the merchant to add a CSV file (upload function) containing the card data, which is to be added to the black list.

...

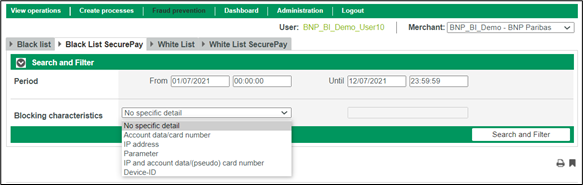

Blacklist SecurePay

The SecurePay is a temporary black list generated by the payment solution according to criteria defined by the merchant such as specifying a maximum number of transactions per day with the same payment card or from the same IP address. When this maximum number is reached, the card number or IP address is automatically placed in the black list SecurePay.

The merchant can only view the full list and remove an entry if he wishes. Therefore, he will not be able to insert entries.

...

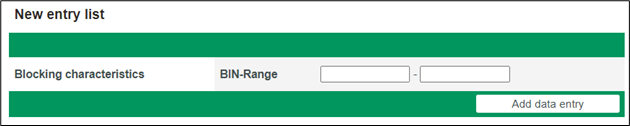

Whitelists

The merchant has the option to add BINs (bank Identification Number) manually in the list. The BIN makes it possible to recognize the customer’s card, their country of origin and their issuing bank. Thus, Fraud controls do not apply to transactions with cards on a white list.

Adding an entry is therefore done manually by entering only a range of BIN or by filling in a CSV file.

...

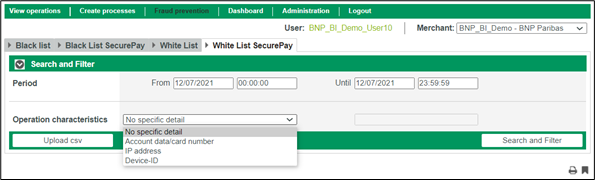

Whitelists SecurePay

The merchant can define criteria (anti-fraud rules) that allow customers not to be limited during their payments. Payment data related to these customers will be automatically added to the white list SecurePay.

User management

The user who will receive his access data to the Back Office in the first place (super-administrator) will be responsible for managing the profiles of his employees by assigning them different access rights and passwords.

...

Users can perform operations according to the rights assigned to them.

...

Access rights (divided into groups):

- Visualization: Right to view certain sections

- Modification: Right to execute operations (captures, cancellations, refunds)

- Creating: Manually create a transaction

- File transfer: Right to transfer BATCH files to the payment solution or receive reconciliation files

- Fraud prevention: Right to manage white lists and black lists (add/remove entries)

- Administration: This section needs to be reserved for a single user who will be responsible for managing users’ access rights and tracing their activities.

...

Create a new user:

The creation of a new user is done at the level of each MID. For the user to to have access to all the merchant’s MIDs, it is necessary to carry out the creation at the mastermind level. If the user is to have access only to a MID of a particular entity, one must log into the MID of the entity in question and follow the steps below for the creation of a user.

...

A password must contain a capital letter, a special character, a number, and at least 6 characters in total.

...

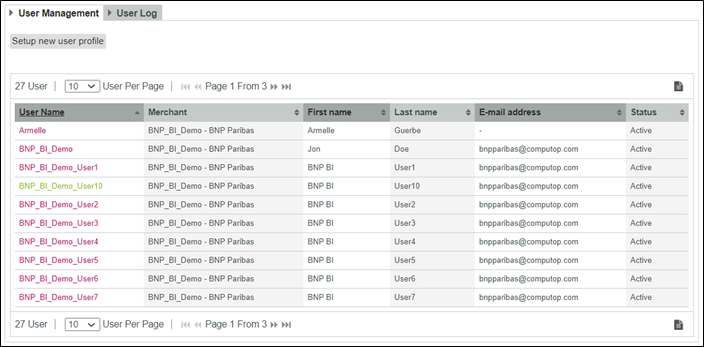

Consult the list of users:

Simply go to the “user management” tab to view the complete list of users. By clicking on a user’s username, you will find details about that user and their access rights. You can also download this information as a CSV document.

...

Consult the Activity log

For safety measures, Visa and MasterCard ask to track the activity of each user who accesses sensitive data. The archived information concerns all the details of each user’s activity in the Back Office.

...